The concept of energy trust funds has gained significant attention in recent years, particularly in the context of renewable energy development and sustainable infrastructure investment. As governments and private entities seek to diversify their energy portfolios and reduce carbon footprints, the role of energy trust funds in facilitating these transitions has become increasingly important. In this article, we will delve into the intricacies of energy trust funds, exploring their mechanisms, benefits, and the key considerations for their effective establishment and management.

Understanding Energy Trust Funds

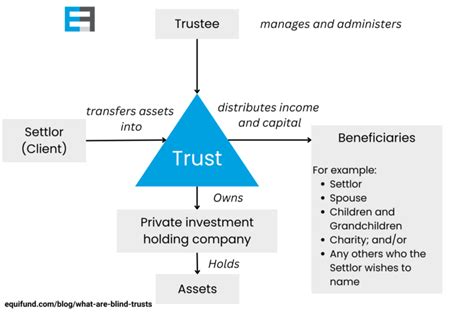

Energy trust funds are financial vehicles designed to support the development and implementation of energy projects, with a focus on renewable energy sources such as solar, wind, hydro, and geothermal power. These funds can be established by governments, private companies, or non-profit organizations, and they operate by pooling resources from various investors to finance energy-related initiatives. The primary objective of energy trust funds is to provide a stable and predictable source of financing for energy projects, thereby mitigating the risks associated with energy development and promoting a more sustainable energy mix.

Key Points

- Energy trust funds support the development of renewable energy projects.

- These funds can be established by governments, private companies, or non-profit organizations.

- The primary objective is to provide stable financing for energy projects, mitigating development risks.

- Energy trust funds promote a more sustainable energy mix and reduce carbon footprints.

- Effective management and transparency are crucial for the success of energy trust funds.

Benefits of Energy Trust Funds

The establishment and operation of energy trust funds offer several benefits, both for the environment and for the economy. Firstly, by supporting the development of renewable energy projects, these funds contribute to a reduction in greenhouse gas emissions and help mitigate the impacts of climate change. Secondly, energy trust funds can stimulate economic growth by creating jobs in the renewable energy sector and attracting investments in sustainable infrastructure. Lastly, these funds can provide a stable source of income for investors, as they are often structured to generate returns through the sale of electricity or other energy products.

| Category | Benefits |

|---|---|

| Environmental | Reduction in greenhouse gas emissions, mitigation of climate change impacts |

| Economic | Job creation in the renewable energy sector, attraction of investments in sustainable infrastructure |

| Financial | Stable source of income for investors through the sale of energy products |

Establishing and Managing Energy Trust Funds

The process of establishing and managing energy trust funds involves several critical steps. Firstly, it is essential to define the fund’s objectives, scope, and investment strategy, ensuring alignment with the overall goal of promoting sustainable energy development. Secondly, the fund’s structure and governance model must be established, including the appointment of a fund manager and the creation of an advisory board. Thirdly, a thorough risk assessment and mitigation strategy must be developed, taking into account market, technological, and regulatory risks. Lastly, ongoing monitoring and evaluation of the fund’s performance are necessary to ensure that it is meeting its objectives and to identify areas for improvement.

Challenges and Opportunities

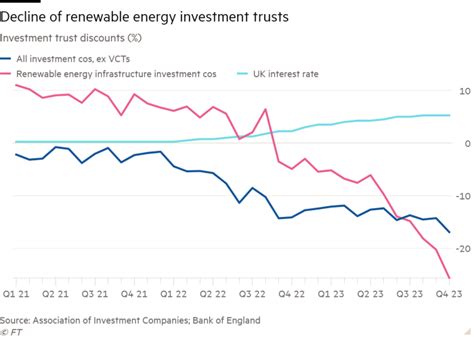

Despite the potential benefits of energy trust funds, there are also challenges and limitations that must be addressed. One of the primary challenges is the high upfront cost of renewable energy projects, which can make them less attractive to investors. Additionally, the intermittency of renewable energy sources can create challenges for grid stability and reliability. However, these challenges also present opportunities for innovation and growth, as advancements in technology and infrastructure can help to mitigate these risks and improve the efficiency of renewable energy systems.

In conclusion, energy trust funds play a vital role in promoting the development of renewable energy projects and supporting the transition to a more sustainable energy mix. By understanding the benefits, challenges, and key considerations for the establishment and management of these funds, governments, private companies, and non-profit organizations can work together to create a more sustainable energy future.

What are energy trust funds, and how do they support renewable energy development?

+Energy trust funds are financial vehicles designed to support the development and implementation of energy projects, with a focus on renewable energy sources. They operate by pooling resources from various investors to finance energy-related initiatives, providing a stable and predictable source of financing for energy projects.

What are the primary benefits of energy trust funds?

+The primary benefits of energy trust funds include the promotion of sustainable energy development, reduction in greenhouse gas emissions, stimulation of economic growth, and provision of a stable source of income for investors.

What are the key considerations for the establishment and management of energy trust funds?

+The key considerations for the establishment and management of energy trust funds include defining the fund's objectives and investment strategy, establishing a governance model, conducting thorough risk assessments, and ensuring ongoing monitoring and evaluation of the fund's performance.